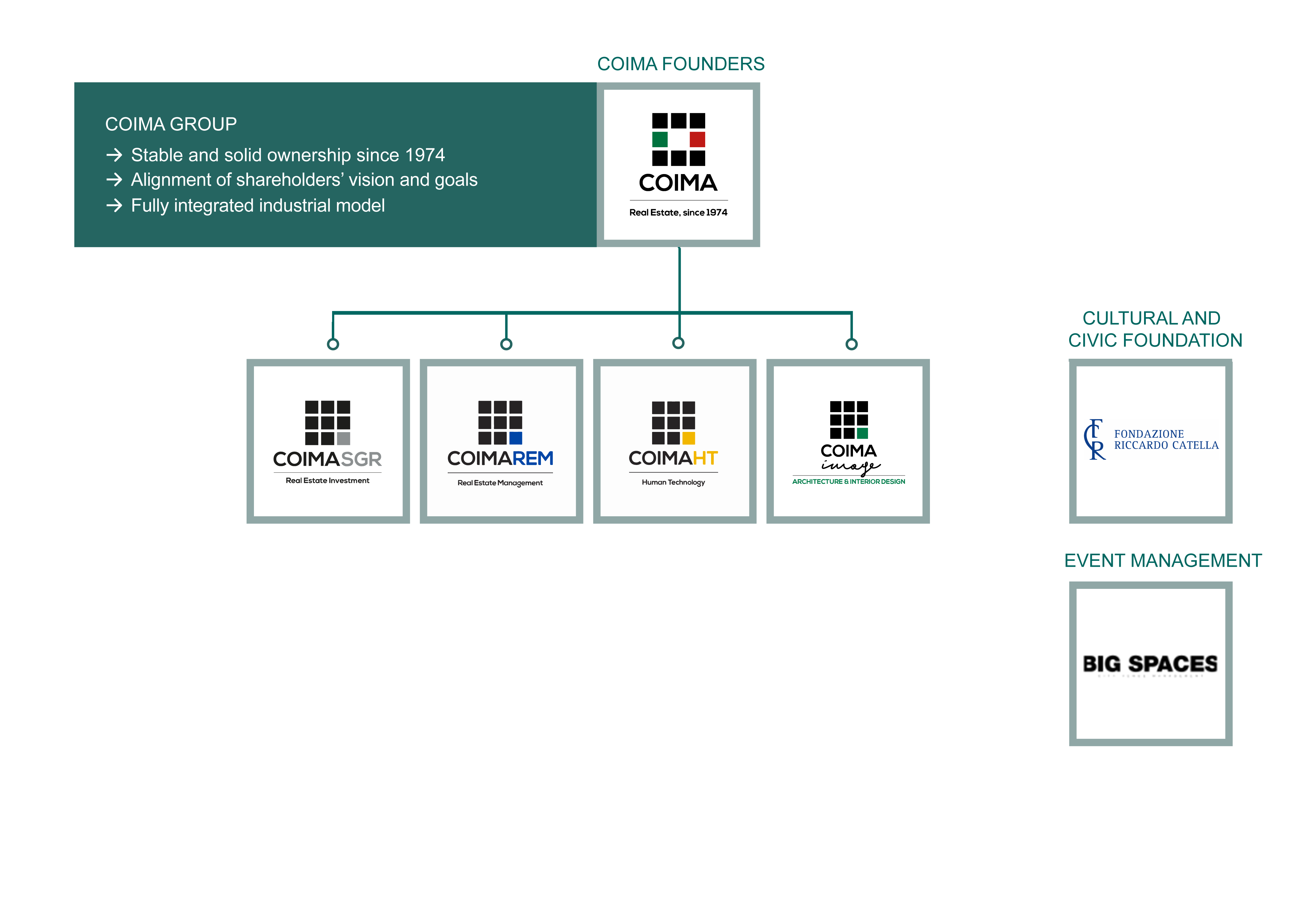

COIMA is a leading group for the investment, development and management of property assets on behalf of international and Italian institutional investors. Active in the Italian real estate sector since 1974, among its most important projects, the group has developed and still manages the Porta Nuova neighborhood, one of the most prestigious urban regeneration plans in Europe.

The companies composing the group, controlled by COIMA Holding, are COIMA SGR, Investment & Asset manager which manages more than 30 alternative real estate investment funds; COIMA REM, Project & Property manager of properties for over 5 million square meters; COIMA HT, a company that operates in the technological and digital field to support the processes of urban regeneration and digital transformation of physical spaces. The COIMA Image company, active in space planning and interior design, is also part of the group.